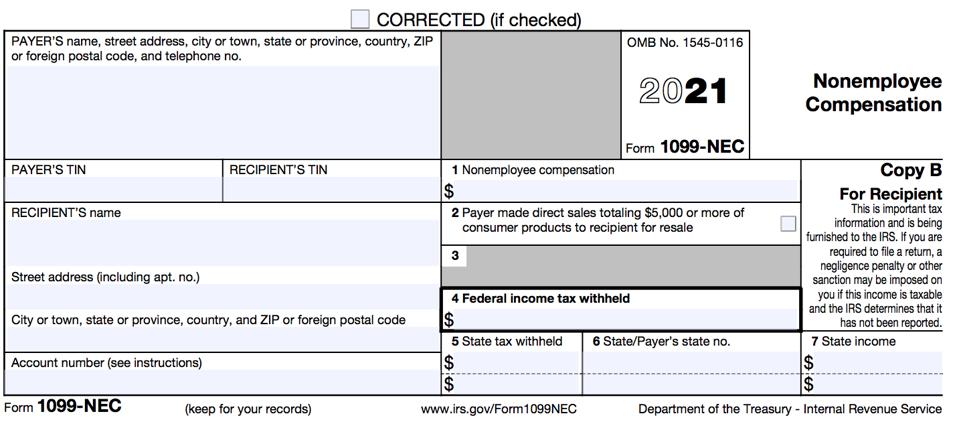

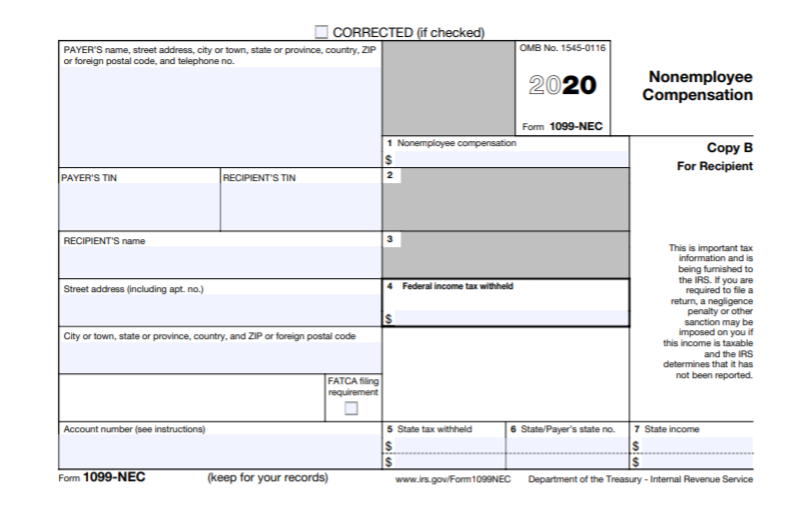

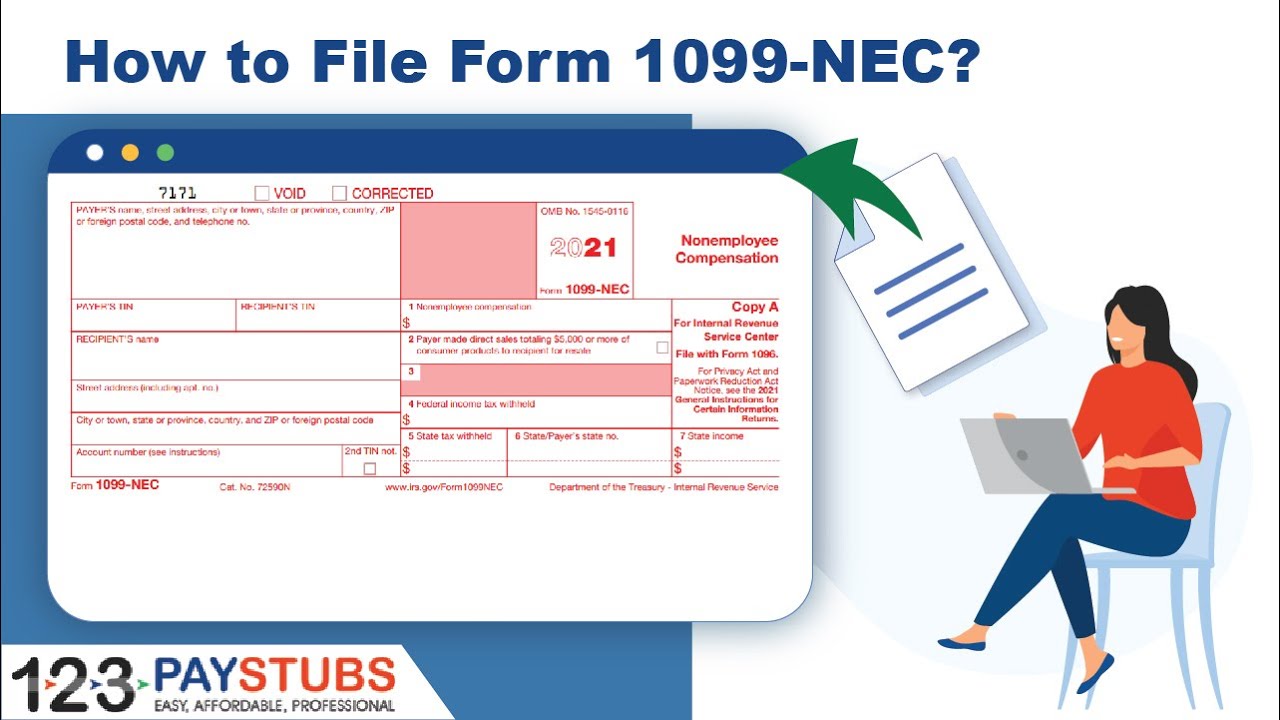

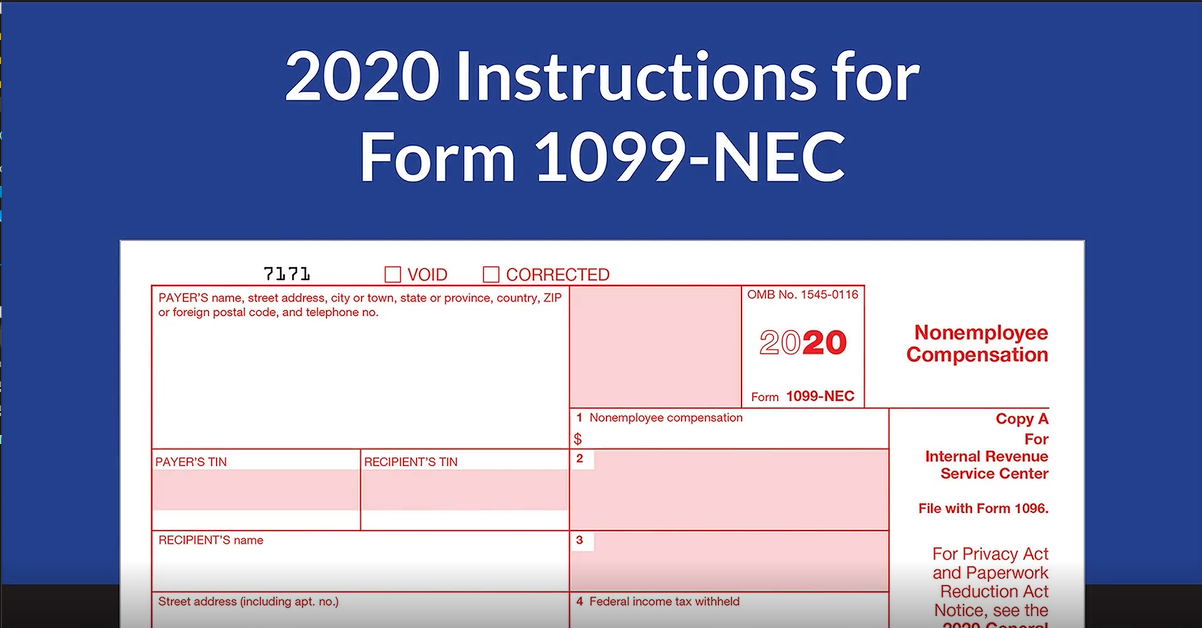

1/25/21 · A 1099NEC form is used to report amounts paid to nonemployees (independent contractors and other businesses to whom payments are made) Nonemployees receive a form each year at the same time as employees receive W2 forms—that is, at the end of January—so the information can be included in the recipient's income tax return9/17/ · Form 1099NEC is used to report nonemployee compensation Compensation only needs to be reported on Form 1099NEC if it exceeds $600 for the previous tax year Nonemployee compensation was previously included on the 1099MISC formThe nonemployee compensation reported in Box 1 of Form 1099NEC is generally reported as selfemployment income and likely subject selfemployment tax Payments to individuals that are not reportable on the 1099NEC form, would typically be reported on Form 1099MISC

Form 1099 Misc Instructions

Does 1099-nec replace 1099-misc

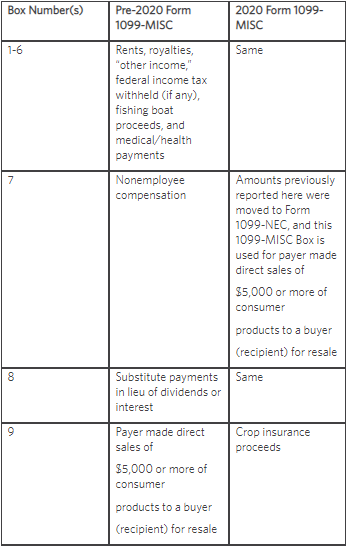

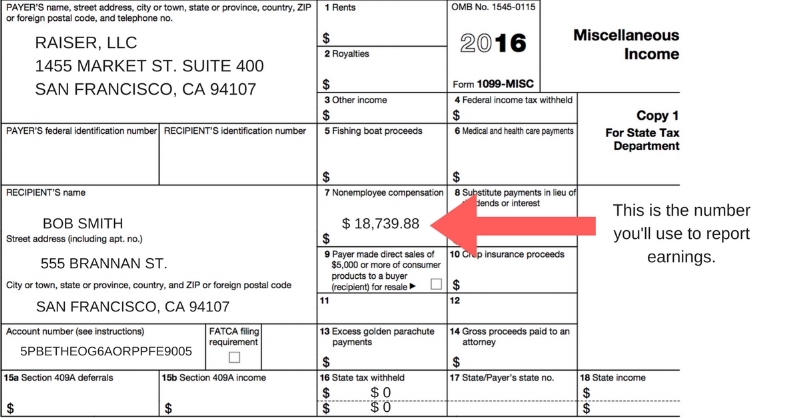

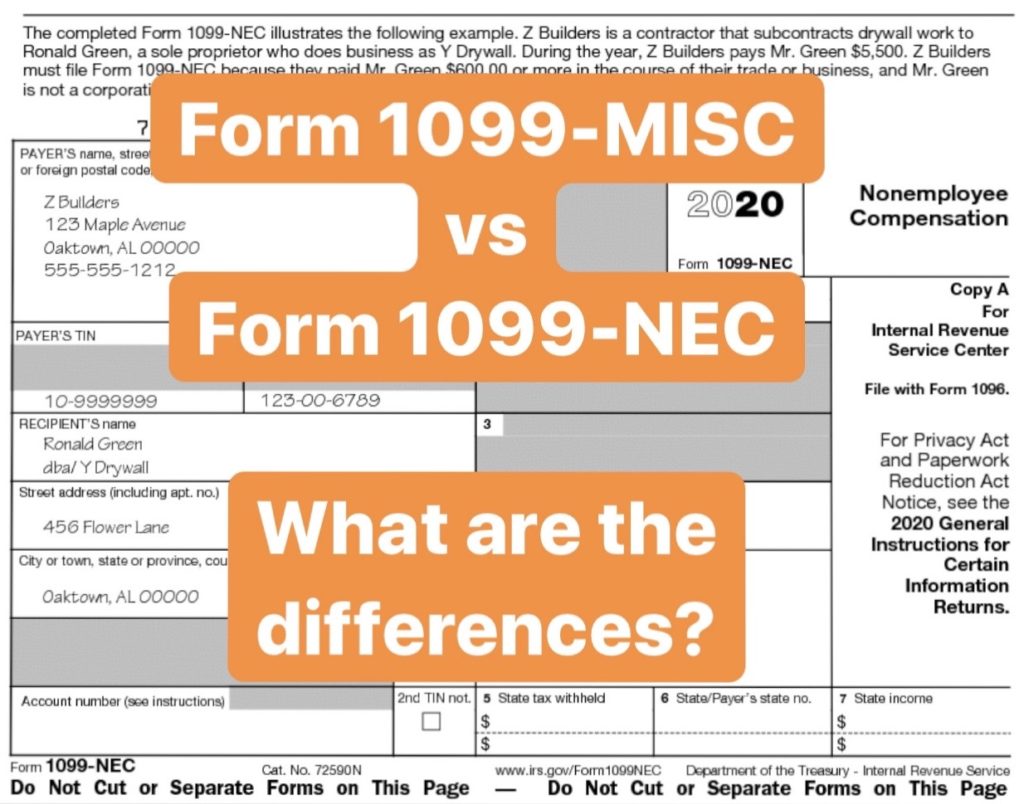

Does 1099-nec replace 1099-misc-Beginning in Drake, nonemployee compensation will be reported on Form 1099NEC, line 1, not on Form 1099MISC, line 7 More information may be found in Form 1099NEC Instructions Form 1099NEC is located on the General tab of data entry on screen 99NThere is also a link on the 99M screen, in the top left hand corner, that goes directly to the 99N screenC Nonemployee compensation7 C, F Selfemployment income Starting in , this income is reported on Form 1099NEC Substitute payments in lieu of dividends or interest 8 8 1 Amount of $10 or more received by the taxpayer's broker as a result of a loan of their securities Payer made direct sales of $5,000 or more of consumer products

1099 Misc Form Reporting Requirements Chicago Accounting Company

2/11/21 · Previously, businesses used Form 1099MISC, Miscellaneous Income, to report nonemployee compensation and a number of miscellaneous payments to vendors (eg, rent) Depending on your business activities during the year, you may need to prepare both Form 1099NEC and Form 1099MISCThe renewed Form 1099NEC is only used for nonemployee compensation, meaning it only replaces Box 7 on the Miscellaneous income form Everything else is still filled under the same Form 1099MISC That means that rents, attorney fees, crop insurance proceeds, proceeds from a fishing boat, the state earned income, etc, and many more, are stillForm 1099NEC Nonemployee Compensation An entry in Box 7 for nonemployee compensation would usually be reported as selfemployment income on Schedule C Profit or Loss from Business The payer of the miscellaneous income did not withhold any income tax or Social Security and Medicare taxes from this miscellaneous income

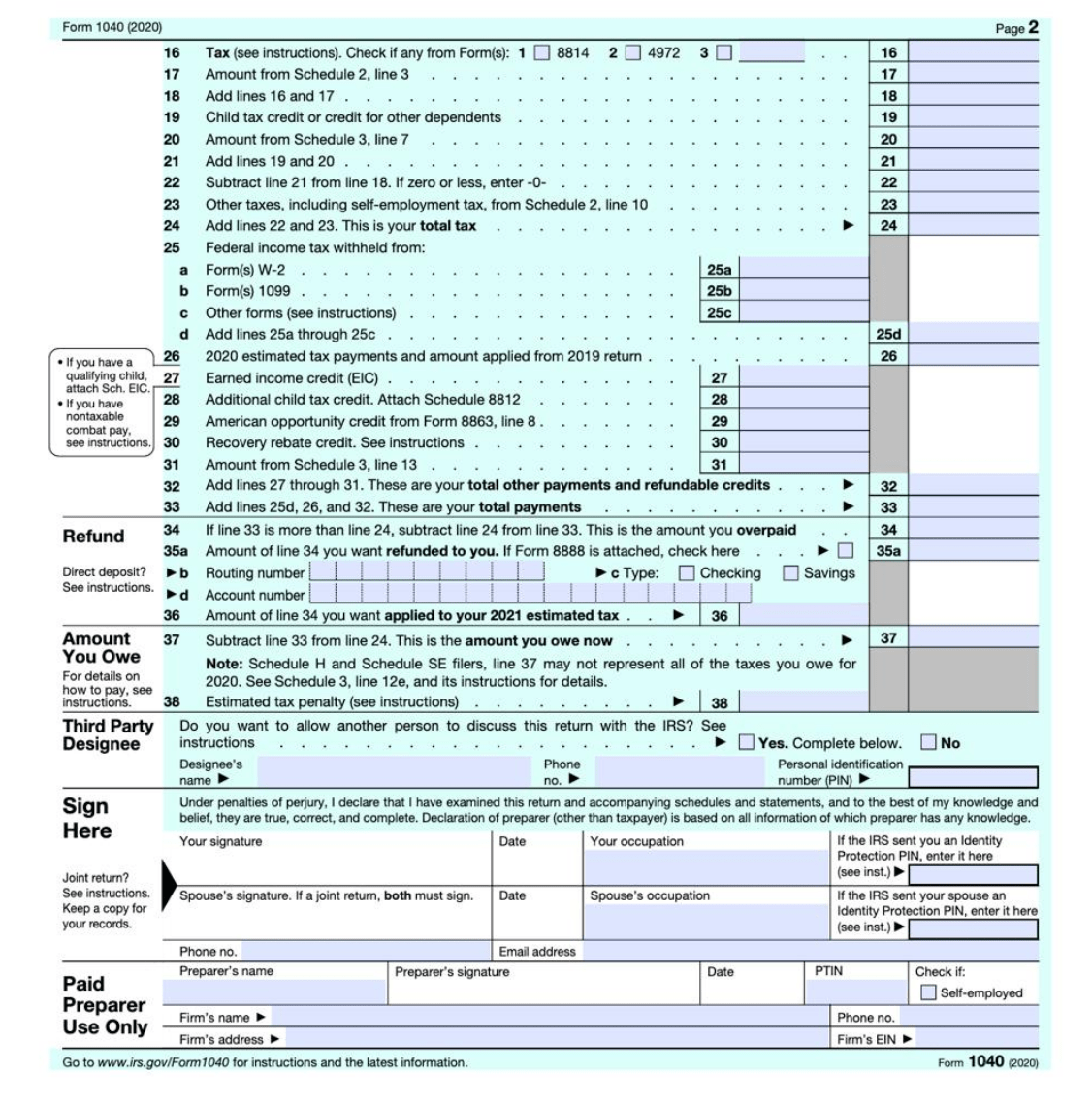

2/2/21 · If you received the Form 1099NEC for a nonemployee compensation, you should enter the information in both Form 1099NEC and Schedule C sections I will suggest you to add the Schedule C See below for instructions You would start from the 1099NEC section under "1099MISC and Other Common Income"1099 NEC Online Filing Requirements for Form 1099 NEC is the separate form to report nonemployee compensation to the IRS 1099 MISC Box 7 should report separately on IRS Form 1099 NEC If you made of $600 or more to an individual, then report it to the IRS by Filing 1099 NECDownload Fillable Irs Form 1099nec In Pdf The Latest Version Applicable For 21 Fill Out The Nonemployee Compensation Online And Print It Out For Free Irs Form 1099nec Is Often Used In Us Department Of The Treasury Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms

· Nonemployee compensation is reported on Form 1099MISC and represents any earnings paid to you by a company when you are not acting in the capacity of an employee Payments under $600 in a given tax year are not required to be reported by the payer, so he may not file a 1099MISC for youNonemployee Compensation on 1099 NEC Form For more details regarding IRS Form 1099 NEC, contact our customer care number on 1 (316) To File your IRS 1099 Form NEC, visit our website at wwwefile1099misccom We are offering 24 hours helpline services for the clients So, you contact our support at any time to solve your issuesWhen you receive a 1099MISC with income in Box 7 that is for nonemployee compensation, the IRS requires that this income be reported on a Schedule C If you are filing a 1099MISC with income in Box 7, you will be prompted to Add the income to an existing Schedule C or create a new Schedule C after completing the 1099MISC entry

What Is A 1099 Form H R Block

What You Need To Know About Instacart 1099 Taxes

1/11/21 · s 1099MISC, 1099NEC, taxes, business, IRS, nonemployee compensation, nonemployee compensation, schedule c, self employment income, selfemployed This entry was posted on Monday, January 11th, 21 at 505 pm and is filed under Tax and Life Changes, Tax Deadlines, Tax for Business, Tax News9/9/19 · 1099NEC Nonemployee compensation (Box 1) Most businesses will choose this box Enter nonemployee compensation (NEC) of $600 or more Include fees, commissions, prizes and awards for services performed as a nonemployee, other forms of compensation for services performed for your trade or business by an individual who is not your employee, and7/28/19 · The Internal Revenue Service has resurrected a form that hasn't been used since the early 1980s, Form 1099NEC, Nonemployee Compensation, with a draft version available for preview on its website Since 19, the IRS has required businesses to instead file Form 1099MISC for contract workers and freelancers

Form 1099 Nec Is Making A Come Back

What Is Irs Form 1099 Nec Everything You Need To Know

Form 1099NEC replaces Form 1099MISC with box 7 data as the new form for reporting nonemployee compensation This change is for the tax year, which are filed in 21 Why the Change Occurred Back in 15, the PATH (Protecting Americans from Tax Hikes) Act changed the due date for 1099MISC forms with data in box 7 from March 31 toIf a 1099MISC was received reporting an amount on Form 1099MISC, line 7, an entry can be made on screen 99M, line 7 Make a selection from the For drop list so the software will know which form or schedule to which the compensation should flow For selfemployed income, select either C Schedule C, Profit or loss from business1/4/21 · Answer Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship) Also file Schedule SE (Form 1040), SelfEmployment Tax if net earnings from selfemployment are $400 or more This form allows you to figure social security and Medicare tax due on your net selfemployment income

Understanding Your Doordash 1099

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

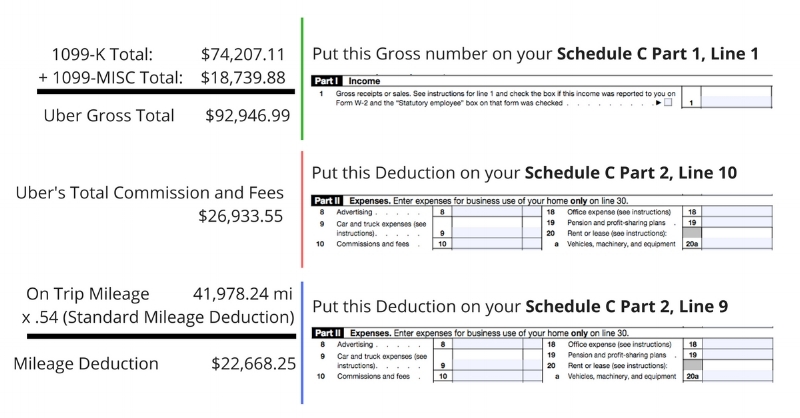

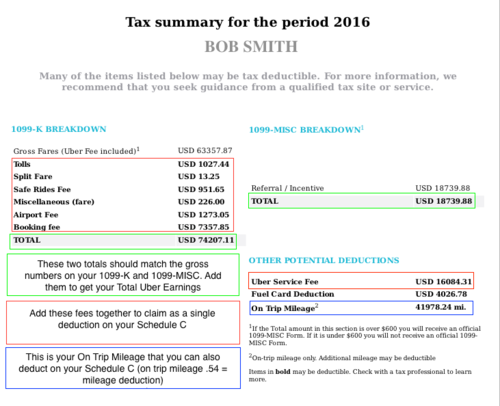

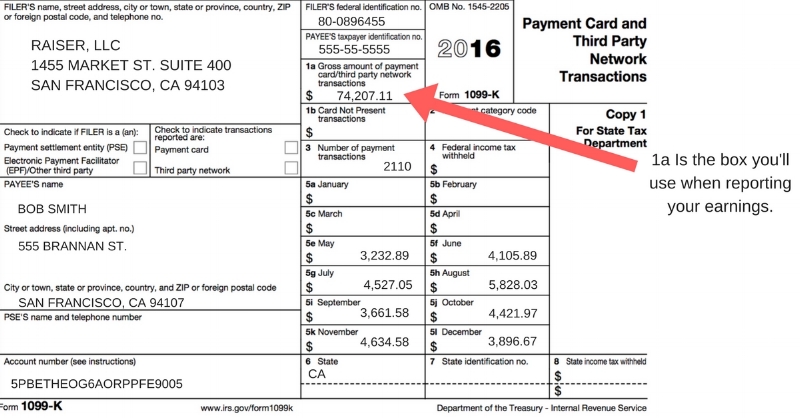

11/27/ · If you're filling out a Schedule C Add the 1099K and 1099NEC earnings amounts together Then, report your total income (from your 1099NEC and your 1099K) all on Line 1 of your Schedule C If you didn't receive a 1099NEC but have referral and incentive income to report, you can include it as "Other income" for your business1/29/21 · Related 7 tax tips for your side hustle Important to note Starting tax year , Form 1099NEC replaces Box 7 on Form 1099MISC Form 1099NEC, Nonemployee Compensation, is specifically for selfemployed individuals, gig workers and other people who made income from a business outside the employee/employer relationshipForm 1099NEC was an active form until 19, it is now returning to the spotlight for tax year The IRS relaunched 1099NEC because of the confusion in the deadline to file 1099MISC with nonemployee compensation Until 15, the deadline to file 1099 MISC with nonemployee compensation and other miscellaneous payments was February 28

1099 Nec Form Quicken

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

2/5/21 · Starting in tax year , nonemployee compensation may be reported to your client on Form 1099NEC In previous years, this type of income was typically reported on Form 1099MISC, box 7 To access the Form 1099NEC Worksheet Press F6 on the keyboard to open the Forms List Type 99N on your keyboard to highlight the 1099NEC Wks Select OK5/11/21 · It was last used in Form 1099NEC is used to report nonemployee compensation Schedule C Profit Or Loss From Business Definition If you have questions about reporting on Form 1099NEC call the information reporting customer service site toll free at or not toll freeNonemployee compensation on a 1099NEC is selfemployment income and needs to usually be reported on Schedule C (or Schedule F if it is farm income) even if you are just doing a little bit of work on the side and do not have an official business The IRS considers any income reported in Box 1 of the 1099NEC as selfemployment income and looks for

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Misc Other Income Vs Nonemployee Compensation My Walk Tax Time

Shows nonemployee compensation and/or nonqualified deferred compensation (NQDC) If you are in the trade or business of catching fish, box 1 may show cash you received for the sale of fish If the amount in this box is selfemployment (SE) income, report it on Schedule C or F (Form 1040 or 1040SR), and complete Schedule SE (Form 1040 or 1040SR)1/16/21 · For tax year , businesses must start to use a redesigned Form 1099NEC, Nonemployee Compensation for reporting certain payments to nonemployees, such as independent contractors Businesses must issue the form to payees by February 1, 212/8/21 · Income reported on Form 1099NEC must be reported on Schedule C, the program needs to link these two forms together to be sure that it is reported correctly and on the right form If you have already entered your 1099NEC, you will need to revisit the section where you entered the Form 1099NEC on its own and delete that entry

Rcjvpmvvc0vwkm

Nonemployee Compensation Reportable On Revived Form 1099 Nec For Payments Lexology

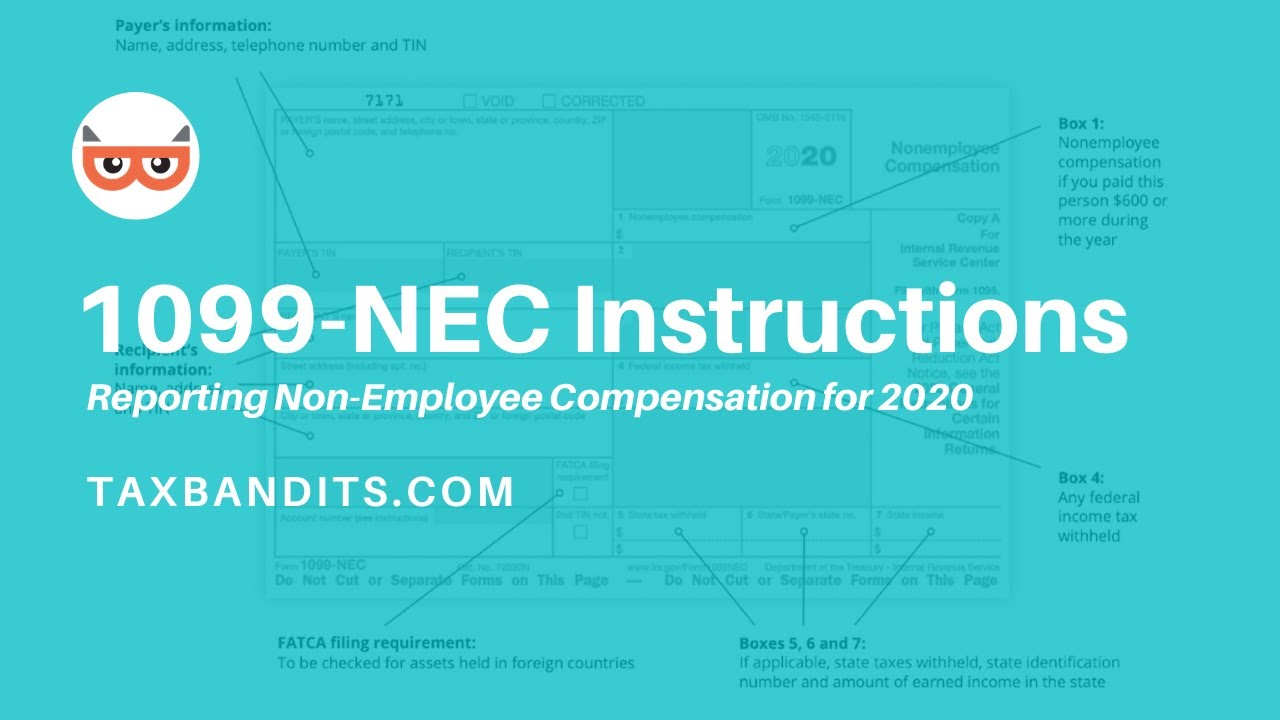

11/25/ · IRS Form 1099NEC is filed by payers who have paid $600 or more as nonemployee compensation for an independent contractor or vendor (ie, nonemployee) in a calendar year The form must be filed with the IRS and also a copy of the return must be furnished to the recipient 2 Who must file Form 1099NEC? · Essentially, the difference between forms 1099NEC and 1099MISC is that nonemployee compensation used to be reported in Box 7 of Form 1099MISC Now, Box 7 has been separated out into its own form NEC payments are now reported in Box 1 of this new form, 1099NEC Form 1099MISC still exists, but it has been modified and redesignedNonemployee compensation is usually reported on a Form 1099NEC Enter this on the Add / Edit / Delete 1099NEC or 1099MISC Income screen The 1099NEC

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

1099 Misc Vs 1099 Nec Understanding Tax Form Differences And Deadlines

4/29/ · If you make qualifying payments to nonemployees in , you'll need to file Form 1099NEC in the 21 tax season This incoming form is replacing Form 1099MISC for reporting nonemployee compensation Here's everything you need to know about Form 1099NEC—when to use it, how to fill it out, and filing deadlines5/5/ · The 1099NEC is a different form than the 1099MISC Form 1099NEC reports nonemployee compensation, whereas Form 1099MISC reports other miscellaneous income Starting in , businesses need to report nonemployee compensation on a separate Form 1099NEC in addition to any other miscellaneous income reported on Form 1099MISC5/7/21 · In more recent years, prior to , nonemployee compensation was reported in box 7 on the Form 1099MISC Form 1099NEC was resurrected to solve confusion related to dualfiling deadlines on the

1099 Misc Form Reporting Requirements Chicago Accounting Company

:max_bytes(150000):strip_icc()/Schedule-C-1040-Form-b15a78b583c04e4b80c96ff1d0fee048.png)

What Is Schedule C On Form 1040

2/5/21 · Select the Add button on the left side of your screen to create a new 1099MISC/NEC for efile Enter the Payer Information from Form 1099NEC Scroll down to the 1099NEC subsection Enter the box 1 amount in (1) Nonemployee compensation Enter the box 4 amount in (4) Federal income tax withheld12/3/ · Form 1099NEC, Nonemployee Compensation, is a form that solely reports nonemployee compensation Form 1099NEC is not a replacement for Form 1099MISC Form 1099NEC is only replacing the use of Form 1099MISC for reporting independent contractor payments And, the 1099NEC is actually not a new form8/25/ · 4 1099NEC Nonemployee Compensation 1099NEC是IRS最新推出的報表。由19與以前年度版本的1099MISC box 7 獨立而來並加上更多欄位。 box 1 的nonemployee compensation 通常有這個收入會搭配Schedule C一起填報。

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

How To Fill Out And Print 1099 Nec Forms

If you're doing all of the 1099 preparations manually, keeping these nonemployee compensation payments separate will save you a ton of time at the end of the tax year Of course, when the end of the tax year comes, you will also need to remember to actually fill out the Form 1099NEC instead of the Form 1099MISC for all of the2/15/ · Essentially, nonemployee compensation is compensation earned from a company when the individual compensated is not on a the payroll However, for purposes of reporting nonemployee compensation on Form 1099NEC it is a bit more complicated than that According to the IRS payment must be reported if all of four conditions are metGenerally, Form 1099NEC Non Employee Compensation is issued to taxpayers when an employer pays $600 or more of fees, commissions, prizes, and awards for services performed by a nonemployee, other forms of compensation for services performed for your trade or business by an individual who is not your employee

What Is Form 1099 Nec

Form 1099 Nec Reporting Nonemployee Compensation Albin Randall And Bennett

· If an individual is paid $600 or higher in nonemployee compensation, they will be issued a 1099NEC for incomeThe IRS has reissued the form 1099NEC for the tax season to replace box 7 on the 1099MISC, which up until recently was standard for reporting nonemployee paymentsAny income appearing in box 7 of a 1099MISC prior to isNonemployee compensation $ 2 3 4 Federal income tax withheld $ 5 State tax withheld $ $ 6 State/Payer's state no 7 State income $ $ Form 1099NEC wwwirsgov/Form1099NEC Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This PageThe IRS has instructions for filling out a 1099NEC on their site If you are an independent contractor receiving a Form 1099NEC you will report that nonemployee compensation, along with other compensation received for your business, on a Schedule C, Profit and Loss from Business, when you file your taxes

Tax Forms Archives Taxgirl

What Is A Schedule C 1099 Nec

Schedule C Multiple 1099 Misc 1099 Nec For Same Business 1099m 1099nec Schedulec

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Freelancers Meet The New Form 1099 Nec

What Is Form 1099 Nec Who Uses It What To Include More

1099 Misc Form Fillable Printable Download Free Instructions

What Is Form 1099 Nec Nonemployee Compensation

Form 1099 Nec Nonemployee Compensation 1099nec

Form 1099 Nec Is Making A Come Back

Form 1099 Misc Instructions

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec What It S Used For Priortax Blog

1099 Nec And 1099 Misc What S New For Bench Accounting

Ultratax Cs Tax Forms Zbp Forms

Understanding Your Instacart 1099

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

:max_bytes(150000):strip_icc()/MiscellaneousIncome-dff90d4dcb754dd1a08e153167070669.png)

Irs Form 1099 Misc What Is It

Form 1099 Nec Nonemployee Compensation 1099nec

What The New 1099 Nec Nonemployee Compensation Means For Your Restaurant Business Restaurant365

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

Yearli W 2 1099 1095 Online Filing Program

Irs Introduces New 1099 Nec Form To Report Nonemployee Compensation

1099 Misc Vs 1099 Nec Understanding Tax Form Differences And Deadlines

1099 Nec Conversion In

Self Employed Vita Resources For Volunteers

How Do I Link To Schedule C On My 1099 Misc For Bo

I Received A Form 1099 Nec What Should I Do Godaddy Blog

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

What Is A 1099 Nec Stride Blog

Tax Statements You Need To File Your Return Don T Mess With Taxes

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Re 1099 Misc Income Doesn T Appear On Schedule C

Solved Re 1099 Nec Box 1 Non Employee Compensation Doubl

Irs Introduces Form 1099 Nec To Replace 1099 Misc Tac Requests All W9 S Be Submitted By Friday 1 15 Business Tax Accounting Chantilly Business Tax Prep Va Business Tax Advisors Northern Va Total Accounting Care

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Form 1099 Nec What It S Used For Priortax Blog

What Is Form 1099 Nec Nonemployee Compensation

What You Need To Know About Form 1099 Nec Blog Taxbandits

Why Didn T Uber Eats Send A 1099 Why 1099 K Entrecourier

1099 Misc Form Fillable Printable Download Free Instructions

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

New For Independent Contractors Now Reported On Form 1099 Nec Manada Tax Service Pc

How To Fill Out And Print 1099 Nec Forms

Ready For The 1099 Nec Emc Financial Management Resources Llc

Due Feb 1 21 Form 1099 Nec For Tax Year Firm Of The Future

How Do Uber And Lyft Drivers Count Income Get It Back Tax Credits For People Who Work

How To File Form 1099 Nec For Tax Year 123paystubs Youtube

Form 1099 Nec Nonemployee Compensation Definition

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

What Is Irs Form 1099 Nec Everything You Need To Know

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

What Is A Schedule C 1099 Form

Freelancers Meet The New Form 1099 Nec

Do I Need To File 1099s Deb Evans Tax Company

1099 Nec Schedule C Won T Fill In Turbotax

What Is An Irs Schedule C Form And What You Need To Know About It

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Memo For 1099 Nec Replaces 1099 Misc For Nec Non Employee Compensation Chris Whalen Cpa

Instructions For Forms 1099 Misc And 1099 Nec 21 Internal Revenue Service

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Re 1099 Misc Income Doesn T Appear On Schedule C

Form 1099 Nec Block Advisors

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

The New Form 1099 Nec And The Revised 1099 Misc Are Due To Recipients Soon

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

What Is Form 1099 Nec For Nonemployee Compensation

It S Time To Get Ready For The New Form 1099 Nec Kraftcpas

What Should I Put Into The Blank Next To Schedule

1099 Rules For Business Owners In 21 Mark J Kohler

Form 1099 Nec Is Making A Come Back

Your Ultimate Guide To 1099s

0 件のコメント:

コメントを投稿